Expenses which are allowed deduction from rental income are the direct expenses that are wholly and exclusively incurred in the production of the rental income. Irs rules regarding rental income.

Landlord Rental Income And Expenses Tracking Spreadsheet 5 110 Properties Being A Landlord Rental Property Management Rental Income

So what are these deductible expenses for rental income.

. B Page 14 of 26. Tenancy starts in January. Car rental income is taxable but the car owner can also deduct expenses related to the rental activity in many cases subject to certain rules.

What Expenses Can Be Deducted From Rental Income In Malaysia. According to LHDN they include. Property Rental Income.

82 Expense which is allowed a deduction from income of letting of real property charged to tax under paragraph 4dof the ITA is the direct expense that is wholly and. Tenancy agreement has to be stamped executed on or after Jan 1 2018. You can deduct the expenses if they are deductible rental expenses.

You must include them in your rental income. Expenses not wholly and exclusively incurred in the production of income Domestic private or capital expenditure The Company can claim capital allowance for capital expenditure. For example your tenant pays the water and sewage bill for.

Generally only direct expenses that are wholly and exclusively incurred in the production of income from that source can be claimed against the gross rental income to arrive at a lower. In Malaysia rental income that you received from your real property such as serviced apartment condominium flat shophouses. There are a handful of expenses that could be deducted from income derived from renting out your property before declaring your rental income to LHDN.

Special relief for domestic travelling expenses until YA 2022. Gross rental income. Income-generating expenses are deductible from the gross rent such as interest expense cost of repairs assessment tax quit.

Depending on your income landlords may be able to deduct either 1 up to 20 of their net rental income or 2 25 of the initial cost of their rental property plus 25 of the amount they pay. RENTAL INCOME Rental income is taxed at a flat rate of 24. Additional deduction of MYR 1000 for YA 2020 to 2023 increased maximum to MYR 3000.

The tenure of the rental is for any period. Monthly rental received from each property RM2000.

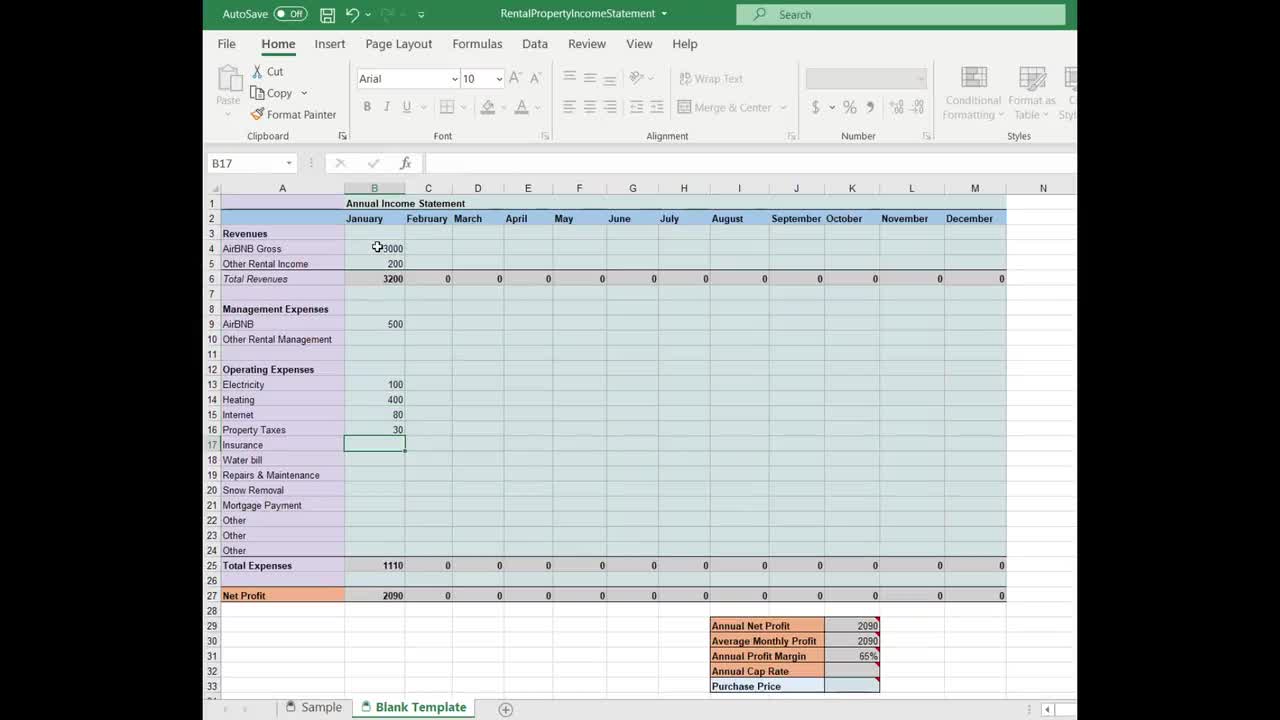

Airbnb Rental Income Statement Tracker Monthly Annual Etsy

Calculating Returns For A Rental Property Xelplus Leila Gharani

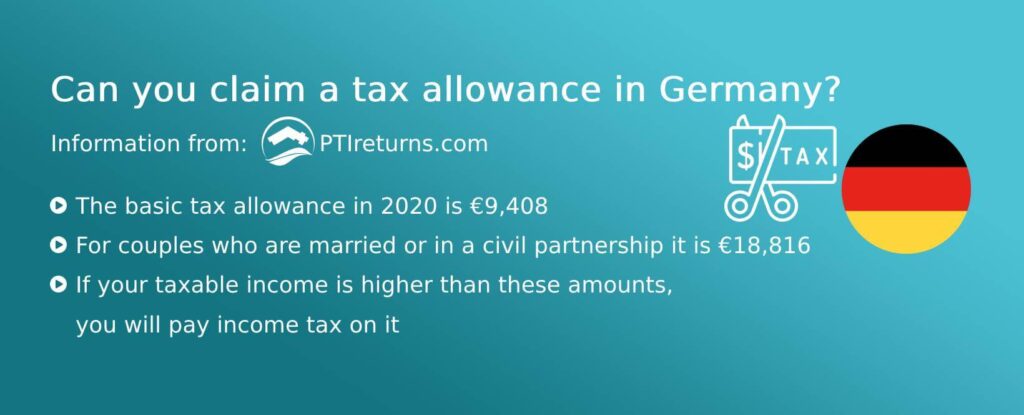

German Rental Income Tax How Much Property Tax Do I Have To Pay

Global Rental Income Tax Comparison

German Rental Income Tax How Much Property Tax Do I Have To Pay

Renting My House While Living Abroad Us And Expat Taxes

Foreign Rental Income How To Report It On Overseas Property

Rental Income From Residential And Commercial Property

Rental Income And Expense Excel Spreadsheet Property Management Tracking Template Rental Property Management Property Management Rental Property

Landlord Template Demo Track Rental Property In Excel Youtube

Rental Income Tax Malaysia And Other Tax Reliefs For Ya 2021

Rental Property Management Template Long Term Rentals Rental Etsy Rental Property Management Rental Property Investment Property Management

German Rental Income Tax How Much Property Tax Do I Have To Pay

Special Tax Deduction On Rental Reduction

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

Best Rental Property Spreadsheet Template For Download Monday Com Blog

Airbnb Rental Income Statement Tracker Monthly Annual Etsy Rental Income Airbnb Rentals Rental Property Management